It’s hella rough out there in VC land right now

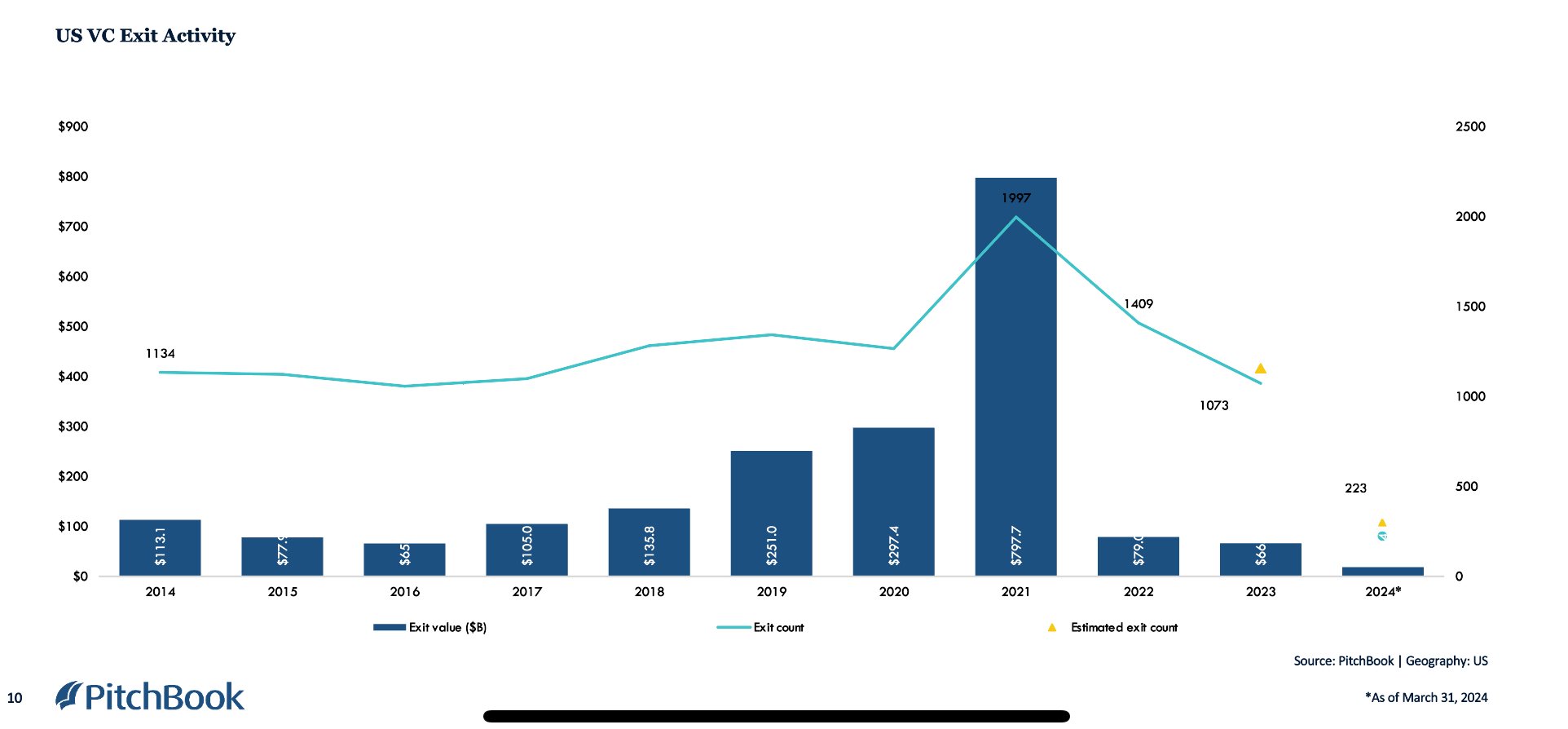

Look, things are bleak out there if you’re raising money. Let’s put some numbers to that: Quarterly investment values decreased by 70% compared to the peak year of 2021, marking the lowest fundraising levels since 2017. This decline is attributed to several factors contributing to a more cautious investment landscape.

Investor caution has increased, largely due to economic uncertainties and previous high valuations in various sectors, all of which are now undergoing corrections. The zero interest rate policies of the past years, which were initially implemented to stimulate economic growth, have led to inflated asset prices and investment bubbles. The policies are normalizing, and the market is experiencing a correction phase.

And then there’s the domino effect of overcrowding into some segments, which has led to fierce competition and fewer unique investment opportunities. This saturation makes it difficult for new entrants to establish a foothold and for existing companies to find fresh capital. It all boils down to one thing: VC-backed companies desperately need exit opportunities, and M&A and IPOs have been more or less dead.

All eyes on AI

Despite the overall slowdown, AI investments have emerged as a dominant sector within the VC landscape. AI-related deals are not only increasing in number but also in the size of assets and valuations. The growth of the AI market, especially in Generative AI applications and cloud infrastructure, is expanding rapidly. Startups are at the forefront of AI innovation, driving significant advancements and attracting substantial VC interest. These startups continue to achieve high valuations, reflecting the high expectations and potential for significant returns. The enthusiasm for AI investments is partly due to their transformative potential across various industries and their capacity to drive new business models and efficiencies.

AI technology is integrated across various industries, transforming operations and creating new business models. Large corporations increasingly deploy AI throughout their operations to enhance efficiency and decision-making. Despite the potential, integrating AI into existing systems presents challenges, including technical compatibility and organizational resistance. However, huge companies like Citi, Klarna, and PwC have successfully implemented AI strategies, demonstrating the effectiveness of tailored AI solutions in enhancing business operations and customer experiences. These case studies provide valuable insights into leveraging AI to achieve significant competitive advantages and operational improvements.

Exit activity took a nosedive, which means VC overall is a lot more risky than it used to be. Overall, LPs can see similar returns by investing in index funds, at much lower risk levels. That’s scary for the VC industry. Screenshot / chart from Pitchbook.

Looking ahead, the future landscape of AI in the venture capital market appears promising, with several emerging trends and opportunities. AI is not just a trend, but a transformative force that is expected to penetrate deeper into various sectors, such as healthcare, finance, and manufacturing, driving further innovations. There is a significant opportunity for VC firms to invest in AI-driven companies that are not just innovating, but poised to redefine industries and create new markets. Continuous advancements in AI technologies, such as improved machine learning models and AI-driven analytics, will likely spur further investment. These technological advancements are not only enhancing the capabilities of AI applications but are also making them more accessible and cost-effective for a broader range of businesses.

The venture capital market, particularly in AI investments, is at a pivotal point. Despite current challenges, the sector presents substantial opportunities for growth and innovation. The integration of AI across various industries and the continuous evolution of AI technologies are not just trends, but key drivers that are expected to shape the future of the venture capital market.

The crucial thing if you want to be an AI company: really be an AI company. Every company will use AI, but that’s no longer a competitive advantage: You’ve got to add something to the data pool or the picks-and-shovels end of things.

Learn much more

Did you know: Our Ready to Raise in 14 days course will teach you everything you need to know to put together a world-class pitch in just two weeks.